We support our Publishers and Content Creators. You can view this story on their website by CLICKING HERE.

Congressional investigators released an interim report Friday detailing some of the creative ways that the Biden administration has apparently sidestepped the legal process in order to spy on and track American citizens, particularly those who have expressed opinions and political views unfavorable to the powers that be.

The report was released just days after Marc Andreessen, co-founder of Netscape,

told Joe Rogan that scores of tech founders were de-banked under the Biden administration through a politically motivated effort he referred to as “Operation Choke Point 2.0,” an apparent update on a scandalous Obama Department of Justice initiative.

Americans’ financial data reveals a great deal about their political viewpoints, interests, vulnerabilities, and locations. The new report from the House Judiciary Committee and its Select Subcommittee on the Weaponization of the Federal Government, titled “Financial Surveillance in the United States: How the Federal Government Weaponized the Bank Secrecy Act to Spy on Americans” noted that “because of this data’s usefulness, federal law enforcement agencies increasingly coordinate with financial institutions to secure even greater access to Americans’ private financial information, often without legal process.”

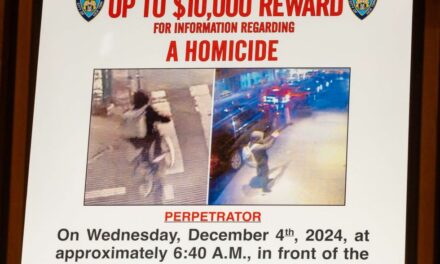

Congressional investigators began looking into the process after a whistleblower alleged that Bank of America voluntarily and without legal process provided the FBI with a list of names of Americans who used a BoA credit or debit card in Washington, D.C., around the time of the Jan. 6, 2021, protests. A former senior FBI official, Joseph Bonavolonta, later confirmed the testimony of the whistleblower, retired FBI supervisory intelligence analyst George Hill.

While law enforcement is

normally barred from inquiring into financial institutions’ customer information, at least without going through proper legal processes, federal agents apparently found a workaround: Highlight as “suspicious” client characteristics common to intended targets — such as criticism of gun-grab policies, vaccine mandates, COVID-19 lockdowns, and the Deep State — and encourage financial institutions to file Suspicious Activity Reports. The Treasury Department’s Financial Crimes Enforcement Network compiles these reports into a searchable database.

‘This could lead to widespread abuse of power and debanking.’

The Weaponization Committee indicated Friday that last year, the FinCEN database was accessed by over 14,000 government employees for more than 3 million warrantless searches.

According to FinCEN’s latest annual report, nearly 15.42% of active FBI investigations in fiscal year 2023 were directly linked to SARs and Currency Transaction Reports. At least 4.6 million SARs and 20.8 million CTRs were filed last year.

The new report from the House Judiciary Committee, which relies on over 48,000 pages of newly reviewed documents and three new transcribed interviews, underscored that federal agencies have increasingly worked “hand-in-glove with financial institutions, obtaining virtually unchecked access to private financial data and testing out new methods and new technology to continue the financial surveillance of American citizens.”

The report claims that:

- the FBI manipulated the Suspicious Activity Report filing process “to treat financial institutions as de facto arms of law enforcement, issuing ‘requests,’ without legal process, that amount to demands for information related to certain persons or activities it considers ‘suspicious'”;

- FinCEN coordinated with the FBI to lean on financial institutions to comb through their data and file SARs on hundreds of Americans “without any clear criminal nexus”; and

- while on paper an advisory body to the Treasury Department on matters pertaining to the Bank Secrecy Act, the BSA Advisory Group has become “a tool for federal law enforcement and financial institutions to monitor the private, financial data of American citizens” — a tool set to become more invasive and more powerful in the hands of federal law enforcement operatives.

The report concludes, “All Americans should be disturbed by how their financial data is collected, made accessible to, and searched by federal and state officials, including law enforcement and regulatory agencies.”

Congressional investigators emphasized that with e-commerce ascendant and the use of cash growing increasingly less common, “the future leaves very little financial activity beyond the purview of modern financial institutions or the government’s prying eyes.”

The Weaponization Committee added on X that “without safeguards, this could lead to widespread abuse of power and debanking.”

The report was not, however, all doom and gloom. Lawmakers highlighted potential legislative reforms that could be undertaken to curb the potential for continued and worse abuse, including

- raising the threshold for currency transaction reports from the $10,000 mark to $60,000, as a means to reverse the CTR’s transformation from a program about criminal activity into a government surveillance program;

- amending the BSA to require that banks notify a customer that an SAR was filed, provide a justification, and offer the flagged client the opportunity to respond to the corresponding allegations;

- restore Fourth Amendment protections to American’s financial records, requiring law enforcement obtain a warrant to gain access to Americans’ private financial information;

“Federal law enforcement has shown that it will leverage any opportunity to operate outside the bounds of the statutes that govern access to Americans’ financial data,” said the report. “Absent adequate congressional oversight and legislative reforms, it is likely that countless more Americans will be subject to financial surveillance and potentially federal investigation, all without ever knowing about it.”

Like Blaze News? Bypass the censors, sign up for our newsletters, and get stories like this direct to your inbox. Sign up here!

Conservative

Conservative  Search

Search Trending

Trending Current News

Current News