We support our Publishers and Content Creators. You can view this story on their website by CLICKING HERE.

The surrogacy didn’t stop for one Vice President Kamala Harris supporting billionaire as he attempted to fault the president-elect for negatively impacting the economy “right now.”

Throughout his campaign, now-President-elect Donald Trump hadn’t been shy about his intention to levy tariffs as a means to reinvigorate the American economy. Remaining opposed to the GOP leader’s plan, “Shark Tank” entrepreneur Mark Cuban painted a bleak picture as he argued preemptive reactions could send prices up.

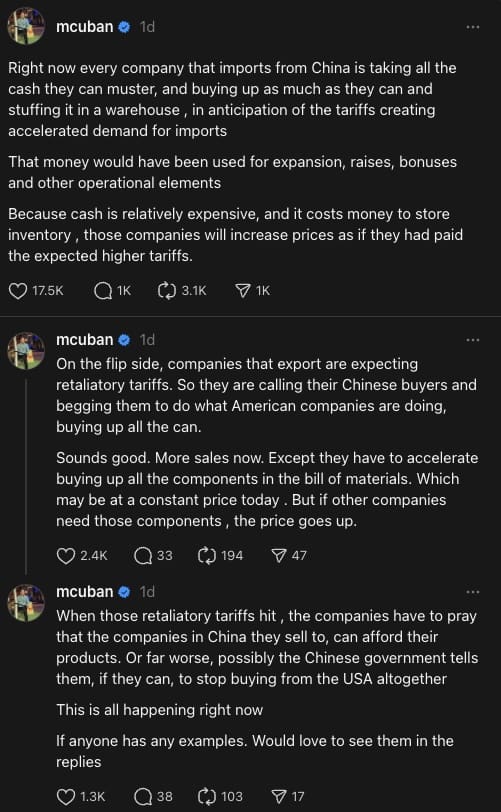

“Right now every company that imports from China is taking all the cash they can muster, and buying as much as they can and stuffing it in a warehouse, in anticipation of the tariffs creating accelerated demand for imports,” he wrote on Threads. “That money would have been used for expansion, raises, bonuses and other operational elements.”

“Because cash is relatively expensive, and it costs money to store inventory, those companies will increase prices as if they had paid the expected higher tariffs,” Cuban continued. “On the flip side, companies that export are expecting retaliatory tariffs. So they are calling their Chinese buyers and begging them to do what American companies are doing, buying up all the [sic] can.”

“Sounds good. More sales now. Except they have to accelerate buying up all the components in the bill of materials. Which may be at a constant price today. But if other companies need those components, the price goes up,” argued the billionaire. “When those retaliatory tariffs hit, the companies have to pray that the companies in China they sell to, can afford their products. Or far worse, possibly the Chinese government tells them, if they can, to stop buying from the USA altogether.”

“This is all happening right now,” he asserted while asking for others to provide examples to prove his point.

Absent from Cuban’s doomsaying on Trump’s tariff plan were the seemingly positive signs from the GOP leader’s return to the White House.

Among the early examples of reactions to the president’s Election Night win was the response from the stock market which saw the Dow Jones Industrial Average, NASDAQ Composite, and S&P 500 each hit record highs that continued to climb before the week closed out.

“There was relief that there was a quick and undisputed election result,” Trade Nation Senior Market Analyst David Morrison told the New York Post.

‘There was relief’: Trump’s historic win drives record highs on Wall Street https://t.co/cZn1594Eu5 via @BIZPACReview

— BPR based (@DumpstrFireNews) November 6, 2024

Further, on Friday European Commission President Ursula von der Leyen conveyed a proposal to begin procuring more liquefied natural gas (LNG) from the United States as opposed to Russia.

“We still get a lot of LNG from Russia and why not replace it [with] American LNG, which is cheaper for us and brings down our energy prices,” she’d said, showing the wide-reaching impact of Trump’s upcoming second administration.

Likewise, while Cuban maintained a negative outlook of Trump’s tariff proposals, Bloomberg had reported that companies were already leaving China, including Steve Madden which reworked a target of 10% reduction to 40% within the next year to avoid the extra costs on imported goods.

“As of yesterday morning, we are putting that plan into motion,” CEO Edward Rosenfeld had said on a Thursday earnings call.

We have no tolerance for comments containing violence, racism, profanity, vulgarity, doxing, or discourteous behavior. If a comment is spam, instead of replying to it please click the ∨ icon below and to the right of that comment. Thank you for partnering with us to maintain fruitful conversation.

Conservative

Conservative  Search

Search Trending

Trending Current News

Current News