We support our Publishers and Content Creators. You can view this story on their website by CLICKING HERE.

Economic changes and the movement to push back against total digital surveillance of daily life by using cash rather than cards to buy things appears to be having an impact, with cash transactions rising for the second year in a row, industry says.

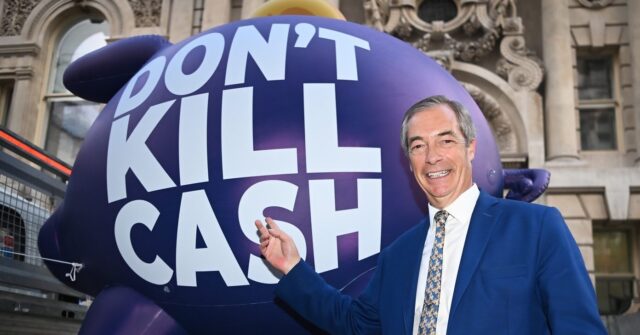

Debanking activist and Brexit leader Nigel Farage has long beat the ‘cash is king’ drum on the importance of not allowing digital transactions to totally dominate everyday life as a protection against banks being able to arbitrarily turn off the ability of individuals to make payments if, say, they have the wrong political views. The view that cash still has utility appears to be permeating, as the British Retail Consortium states cash use has just risen for the second year running, starting a slow fightback against decades of decline againgt cards.

Near a fifth of all transactions in the United Kingdom last year were with coins and notes, 19.9 per cent, up from 18.8 per cent in 2022. Card remains dominant, making up 75 per cent of transactions, with cash having fallen hard from as many as half of all transactions as recently as 2013.

British Retail Consortium states the economy’s condition, with many turning to cash as an easy way to budget — as you can’t overspend money you don’t physically hold — is a part of the explanation for the turn back to paper money. Their spokesman said: “Cash remains a vital form of payment for a sizeable minority of the population, particularly for its role in budgeting. This has made it important to many households during the recent cost of living squeeze.”

Critically, this return to physical money comes at a time when more businesses, venues, and services have started to refuse cash altogether, insisting on card payment. Campaigners say this is a serious issue for groups in society like the elderly and less wealthy who may not have a bank account or the knowledge to use mobile banking.

Others have expressed concern about the demise of cash because digital payments feed into a state of total surveillance, and having no recourse to traditional money can leave individuals unable to pay in the case of a technical error or even ‘debanking’, where financial institutions move to withdraw their services. The Swedish government recently underlined the utility of cash in an emergency, which, in its advice on preparing for war, told citizens to hold a week’s worth of cash in case digital payment systems were cyber-attacked.

Brexit leader Nigel Farage has been the victim of an attempted debanking by a major British bank and has taken up the cause of others similarly impacted. In 2023, he used the example of the Canadian Trucker protest, who were punished for disobeying the Canadian government by having their bank accounts frozen to warn of the perils of a ‘cashless society’.

He had said then: “Look, it happened in Canada. Remember the Canadian truckers. People who had gone about their business legally for years, suddenly a vaccine mandate came in, many didn’t agree with it. They protested peacefully in Ottawa, and what Justin Trudeau the PM do? He froze their bank accounts. You see, this can be misused in very, very frightening ways.”

Farage delivered the ‘Don’t Kill Cash’ petition with 300,000 signatures to Downing Street, which called on the government to “protect the status of cash as legal tender and as a widely accepted means of payment” and reverse the march to a cashless society, stating: “there are strong vested interests pushing for [cash] to be permanently replaced by debit and credit cards and other electronic payments. These cost you more in the long-run and enable 3rd parties to track you and your spending.”.

Just hours after the petition was handed over, the government stated it would fine banks which failed to protect access to cash.

Conservative

Conservative  Search

Search Trending

Trending Current News

Current News